WASHINGTON BUSINESS JOURNAL: A D.C.-based startup that works with businesses to ensure artificial intelligence tools are effectively used and maintained has raised $13.8 million in outside funding to boost its workforce and scale its product.

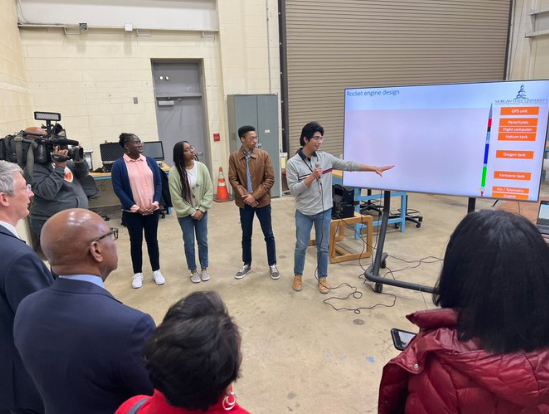

The close of this Series A funding round brings AI Squared’stotal outside investment amount to $19.8 million since CEO Benjamin Harvey, a former data science chief of operations at the National Security Agency, founded the company in 2021.

With this funding, Harvey told me he looks forward to expanding the company’s sales team so that he can take on fewer founder-led sales calls, which he’s done thus far to win customers like Coca-Cola Beverages Florida LLC, cybersecurity platform Rapid7 as well as the U.S. Air Force, U.S. Navy, NSA and the National Geospatial Intelligence Agency. He’s hired Jimmy Oyeniyi, a former Microsoft Corp. and Databricks sales executive, to serve as AISquared’s first chief revenue officer to handle much of this work so that he can work on product development.

“We’re building out sales, marketing and that go-to-market of the organization, but it’s also maturing the product,” Harvey said. “In order to close deals and to speed up the sales cycle, you have to really mature the product. So what we’re doing right now is we’re continuing to hire top talent from an engineering perspective. That’s going to allow us to continue to build out the technology as well.”

New York-based venture capital firm Ansa Capital, which has backed the likes of Fanduel, Peloton, Glassdoor and Orbital Insight, led the Series A funding round for AI Squared. Ansa Capital co-founder and General Partner Allan Jean-Baptiste will join the board of AI Squared, as will angel investor Roger W. Ferguson Jr., a former vice chairman of the Federal Reserve and board member of Alphabet Inc.

“We see a massive market opportunity for AI Squared to solve significant corporate hurdles in AI implementation by simplifying integration into existing workflows and tools while enabling faster time to value for AI investments,” Jean-Baptiste said in a statement.

Harvey said he’s looking to double AI Squared’s 30-personheadcount over the next 12 to 18 months. The “central mass” of that figure reports to the company’s headquarters at the intersection of Eye Street and Pennsylvania Avenue NW — over half of the company’s workforce is based in Greater Washington. He said he’s working with a real estate broker to find between 7,000 square feet and 12,000 square feet of office space to accommodate these growth goals, though he declined to provide the name of the firm he’s working with.

AI Squared’s software-as-a-service AI platform, Harvey said,offers its customers a level of integration that can overlap with their existing tools to provide better insights or analysis on existing data sets. For example, a financial services company uses a customer relationship management (CRM) tool that’s paired with AI Squared’s platform, which has the potential to render new business leads.

“When they’re using the CRM tool, voilà, all of a sudden arecommendation pops up where it understands the lead — it’s been analyzing that leads information, the algorithm and the AI technology automatically — and it says, ‘we recognize that this client had a life event of having a child, you should recommend a 529 plan to that client’ or to that potential client or that lead in the next conversation that you have,” Harvey said.

He added that many companies have deployed AI tools over the past few years but few are seeing a return on investment. Those who use AI Squared’s platform are required to participate in a feedback system, which Harvey said is resulting in higher adoption and usage rates when compared to other AI tools.

“What we do at AI Squared is not only do we accelerate theintegration of the AI insights into the business applications, but we also provide a feedback loop, which is so important for organizations that are looking to increase AI adoption because we provide them with the ability to say, ‘Hey, the model was inaccurate, here’s what the right answer should be,’ and then we use that information to increase the accuracy of the models over time,” he said.

Harvey declined to disclose revenue figures but noted thatfunding of this size, given the company’s valuation, is translating to sales expectations of at least $10 million per year.