MARYLAND MATTERS: Gov. Wes Moore’s initial legislative package is picking up some support from House Republicans.

The General Assembly’s presiding officers this week introduced nine bills on Moore’s behalf, reflecting many of the broad priorities the new governor outlined in Wednesday’s State of the State address and for months before on the campaign trail.

“Each of these bills are important first steps in moving Maryland forward in an equitable way,” Moore’s chief legislative officer, Eric Luedtke, wrote in a memo to lawmakers this week seeking support for the Democratic governor’s legislative package.

The Moore administration hasn’t revealed extensive details about the individual bills, but they are starting to emerge based on the language in each piece of legislation and a written synopsis of the measures that Luedtke, who until recently was House majority leader, provided to his former colleagues. The legislature has yet to release its standard fiscal and policy notes on Moore’s measures.

Each bill has picked up dozens of co-sponsors in the House; notably, six of the nine measures have Republican co-sponsors.

Moore’s bills were introduced in the Senate on Friday but the bill texts and lists of co-sponsors had not been posted on the General Assembly’s website as of Saturday.

One of the most intriguing bills, House Bill 548, known as the Access to Banking Act, would compel Maryland’s commissioner of Financial Regulation to create a Maryland Community Venture Investment Fund. The fund would provide an incentive for banks and credit unions to locate physical branches in low- and moderate-income communities, and would provide capital to financial technology companies to develop tech solutions designed to assist financial institutions in providing necessary lines of credit to small businesses in lower-income communities.

The bill, Luedtke’s memo says, “sets out to improve access to banking in low and moderate income communities” and “seeks to empower entrepreneurs to develop work and wealth in communities across the state.”

Carter Elliott IV, a Moore spokesperson, said in an email that the bill was not directly modeled after any other state or municipal program. The governor’s Legislative Office worked with the commissioner of Financial Regulation’s office, which is within the state Department of Labor, Licensing, and Regulation, to design the legislation.

Del. Jheanelle Wilkins (D-Montgomery), chair of the Legislative Black Caucus, said she expects the measure to gain widespread support within the caucus and among Democrats in the Assembly.

“That’s a huge issue, especially when we’re talking about income inequality, predatory lending and other barriers to prosperity,” she said.

The Maryland Bankers Association did not immediately respond to a request for comment on Friday.

The measure has 62 co-sponsors in the House, including one Republican, Washington County Del. William Wivell. It has been assigned to the House Economic Matters Committee.

Here’s a look at the governor’s other eight bills, with their House bill numbers:

HB 546: The SERVE Act (Serving Every Region through Vocational Exploration)

This is the bill that would set up Moore’s proposed system to provide a service year option for high school graduates to work for community organizations and nonprofit groups. The bill, according to Luedtke’s analysis, “incorporates a flexible design to allow for programs that appeal to a broad spectrum of young people with a wide range of career interests. This program will serve as a springboard for participants to enter into post-service year employment, higher education, or apprenticeships while creating a culture of service in communities across the state.”

The bill has 72 co-sponsors in the House, including three Republicans, and is scheduled for a hearing on Feb. 21 in the Appropriations Committee.

It’s anticipated that the administration will introduce another measure to create an agency to oversee the service program.

HB 547: The Family Prosperity Act

The legislation would permanently extend the state’s Earned Income Tax Credit and would remove the $530 cap for adults without qualifying children. The bill would also expand the state’s Child Tax Credit to cover taxpayers with children 5 and under who have a federally adjusted gross income of $15,000 or less. The bill retains the existing credit for children older than 6, which only applies to children with disabilities.

“This proposal will ensure that Maryland families can focus on their futures instead of where the next meal or pack of diapers might come from,” Luedtke wrote.

The bill, which has 73 co-sponsors — all Democrats — and is scheduled for a hearing in the House Ways and Means Committee on Feb. 16.

HB 549: The Fair Wage Act

This legislation would fulfill Moore’s promise to accelerate the state’s $15-an-hour minimum wage, fully implementing that wage for all covered employers as of Oct. 1 (it currently isn’t supposed to take full effect until 2026). The bill would also index the minimum wage to the Consumer Price Index beginning on July 1, 2025, capped at 5% per year.

The measure has 63 co-sponsors, all Democrats. It has been assigned to Economic Matters.

HB 550: The Clean Energy and Transportation Act

The bill would bolster incentives for people and businesses that purchase electric medium-duty and heavy-duty trucks and charging stations. The bill would allow businesses that switch from fossil fuel-consuming trucks to electric trucks to receive grants that cover 100% of the cost differential. The measure would also enhance incentives to install EV charging stations and would enable the Maryland Energy Administration to cover more of their administrative costs.

The legislation has 69 Democratic co-sponsors and is ticketed for consideration in the House Environment and Transportation Committee.

HB 551: The Broadband Expansion Incentive Act

The measure would create a five-year moratorium on sales and use taxes for broadband infrastructure equipment and would end state taxation of federal broadband grants.

“These proposals ensure that Maryland most effectively deploys these once-in-a-generation federal dollars to close the digital divide and ensure that all Marylanders have access to affordable, high-speed internet,” Luedtke’s memo says.

The bill has 74 co-sponsors, including a dozen House Republicans. It is scheduled for a hearing in Ways and Means on Feb. 16.

HB 552: The Innovation Economy Infrastructure Act

The legislation would establish a pilot program within the state Department of Commerce, the Build Our Future Grant Pilot Program. It envisions leveraging state dollars for grants to businesses, local governments, non-profits, and academic institutions for infrastructure and technology programs.

“The bill pairs with the existing Innovation Investment Tax Credit (IITC) and Biotechnology Investment Tax Credit (BIITC) to expand access to capital and bring about significant tech-driven investment in Maryland,” Luedtke wrote.

The measure, which has 64 co-sponsors, including a handful of Republicans, will be heard in Ways and Means on Feb. 16.

HB 553: The Healthcare for Heroes Act

The bill would establish a program within the Maryland Military Department to reimburse members of the Maryland National Guard for health care and dental premiums that they pay for themselves and their families. It has 71 co-sponsors, including nine Republicans, and will have a hearing in the Appropriations panel on Feb. 21.

HB 554: The Keep Our Heroes Home Act

The bill would expand the state’s existing tax exemption for military retirement income. Maryland currently allows retirees under age 55 to exempt up to $5,000 of military retirement income and retirees over age 55 to exempt up to $15,000. The legislation would eliminate the age distinction and allow for the exemption of up to $25,000 in tax year 2024 and up to $40,000 beginning in tax year 2025.

“Given the significant workforce challenges in Maryland’s high tech industries, we cannot afford to lose workers with specialized and in-demand skills,” Luedtke wrote.

With 66 co-sponsors, including 13 Republicans, the bill will be heard in Ways and Means on Feb. 16.

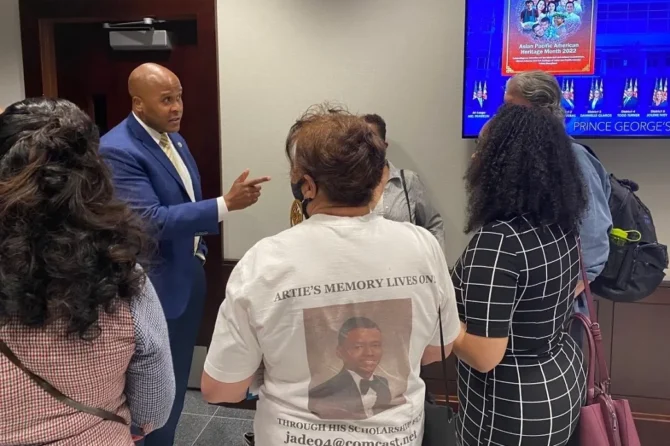

Photo: Gov. Wes Moore (D) greets lawmakers as he moves through the House of Delegates chamber before his first State of the State address. Photo by Danielle E. Gaines.