By Brian Witte

Maryland Gov. Larry Hogan and leaders in the legislature have reached a $1.86 billion agreement for tax relief over five years for retirees, small businesses and low-income families, officials announced Monday.

When combined with a recently enacted gas tax suspension, the governor’s office said this legislative session will deliver nearly $2 billion in tax relief. The Republican governor called the bipartisan deal “the largest tax cut package in state history with major and long-overdue relief for Maryland’s retirees.”

“This agreement will deliver on our promise to provide real, long-term relief for hard-working Marylanders dealing with inflation and higher prices, and help create more jobs and more opportunity to continue our strong recovery,” Hogan said.

The tax relief agreement comes at a time when the state has billions of dollars in surplus that has resulted from enormous federal aid to address the COVID-19 pandemic. The state started the session in January with about $4.6 billion in surplus, and the amount grew even higher as officials revised revenue estimates earlier this month.

The agreement includes tax relief for retirees 65 and older making up to $100,000 in retirement income, and married couples making up to $150,000 in retirement income. Under the deal, 80% of Maryland retirees will get substantial tax relief or pay no state income taxes at all, the governor’s office said. It comprises about $1.55 billion of the overall agreement.

Read more at NBC 4.

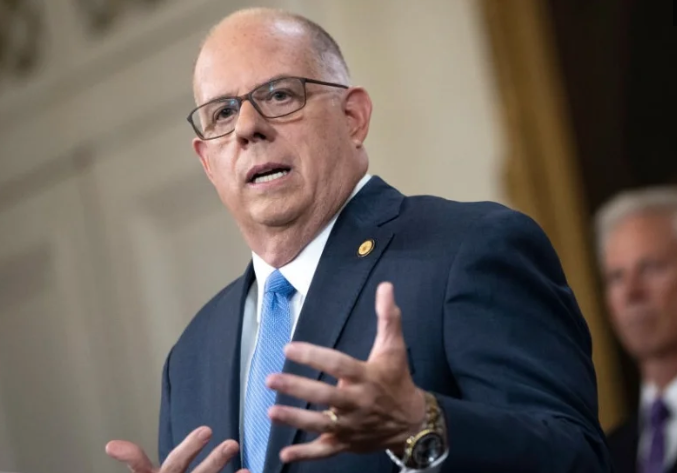

Photo: File photo. Maryland Gov. Larry Hogan at the State Capitol in Annapolis on Aug. 5, 2021.